2024 Publication 15t

2024 Publication 15t. b0cqv282z8 publisher : Tax analysts is a tax publisher and does not provide tax advice or preparation services.

Final 2024 federal income tax withholding methods were released dec. Publication 15 (2024) dated dec.

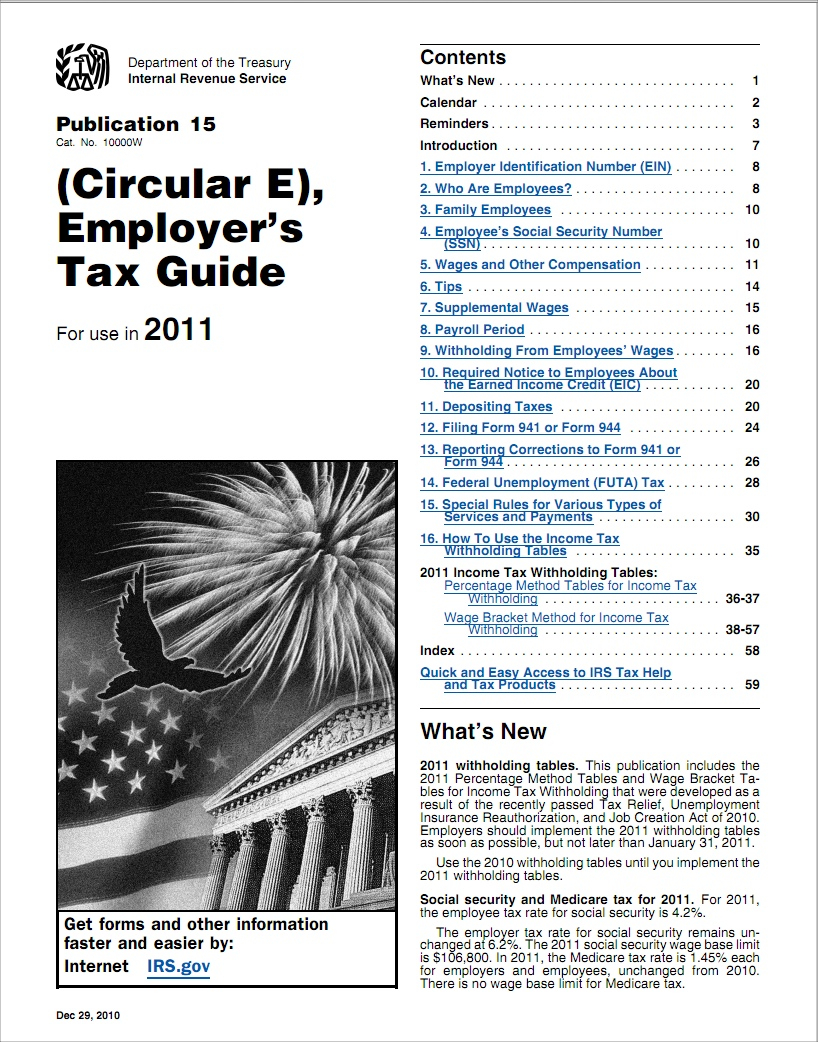

The Internal Revenue Service Released A Draft Of The 2024 Publication 15, (Circular E) Employer’s Tax Guide, On Nov.

Tax analysts is a tax publisher and does not provide tax advice or preparation services.

The Social Security Wage Base Limit Is $168,600.The Medicare Tax Rate Is 1.45% Each For The Employee And Employer, Unchanged From 2023.

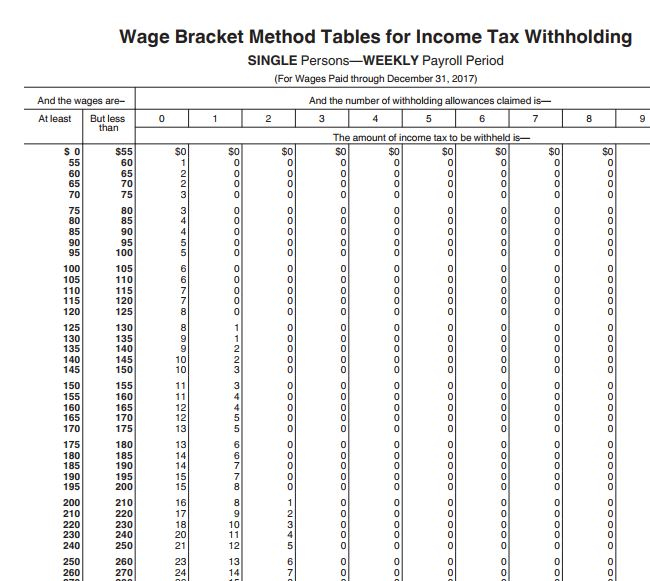

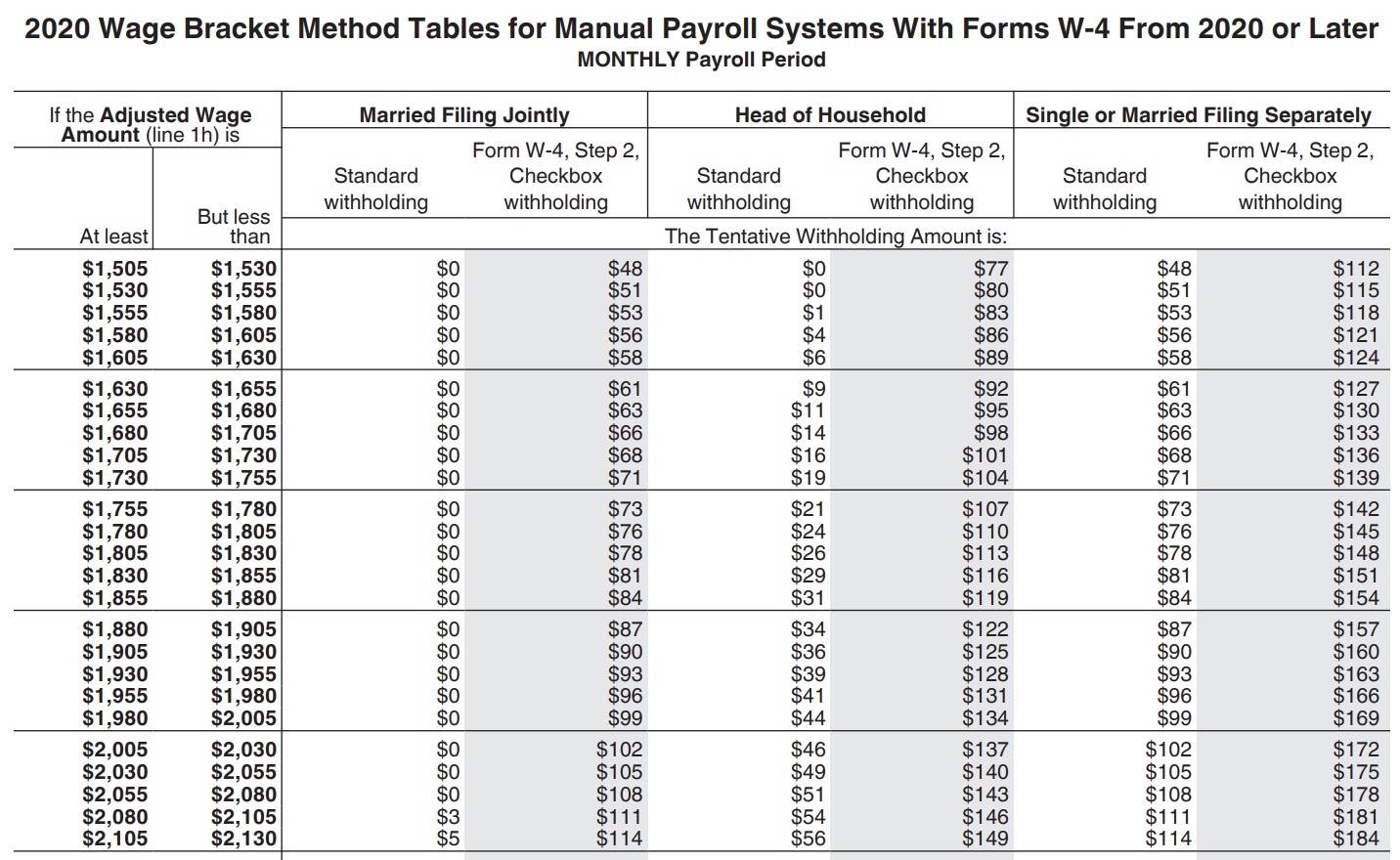

It describes how to figure withholding using the wage bracket method or.

9 By The Internal Revenue Service.

Images References :

Source: www.zrivo.com

Source: www.zrivo.com

Publication 15T 2023 2024, Tax analysts is a tax publisher and does not provide tax advice or preparation services. b0cqv282z8 publisher :

Source: blogs.payroll.org

Source: blogs.payroll.org

IRS Releases 2022 Publication 15T, b0cqv282z8 publisher : Agricultural employers and employers located in us.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

Publication 15 Wage Bracket Method Tables 2021 Federal Withholding, It describes how to figure withholding using the wage bracket method or. The service posted the draft version of.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

IRS Publication 15 2021 Tax Table Federal Withholding Tables 2021, It describes how to figure withholding using the wage bracket method or. There is no wage base limit for.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

Publication 15t 2019 Federal Withholding Tables 2021, This draft publication contains all the federal. Tax analysts is a tax publisher and does not provide tax advice or preparation services.

Source: studylib.net

Source: studylib.net

IRS Publication 15, Circular E, Employer's Tax Guide, 9 by the internal revenue service. There is no wage base limit for.

Source: www.taxuni.com

Source: www.taxuni.com

Pub 15T 2023 2024, Publication 15 (2024) dated dec. Final 2024 federal income tax withholding methods were released dec.

Source: www.taxuni.com

Source: www.taxuni.com

Pub 15T 2023 2024, There is no wage base limit for. Agricultural employers and employers located in us.

Source: maeqnellie.pages.dev

Source: maeqnellie.pages.dev

Federal Tax Table For 2024 Becca Carmine, The service posted the draft version of. This draft publication contains all the federal.

Source: www.zrivo.com

Source: www.zrivo.com

Publication 15T 2023 2024, b0cqv282z8 publisher : Tax analysts is a tax publisher and does not provide tax advice or preparation services.

The Fixed Exemption Amount Is To Be $12,900 For Those Married Filing Jointly;.

The 2024 tables for federal income tax withholding are now available, irs said during a recent payroll industry call.

This Draft Publication Contains All The Federal.

9 by the internal revenue service.